BUYING CRITERIA

Buying Criteria

Whether you’re coming to Blue-Ocean Capital Holdings as a passive investor, buyer, seller, or real estate broker/agent, you’ll want to know how we run our business and the properties we buy, owner/operate, and invest in. It’s important to us to show transparency, integrity, and accountability as part of our core values. To keep our reputation as Ohio’s leading real estate investment solutions company, we need to follow strict purchasing criteria. Here’s your opportunity to look “under the hood” at our criteria.

What We Buy

Our primary aim in buying properties is Class B real estate. These Class B properties are typically found in neighborhoods with growing desirability, stable employers, middle incomes, and well regarded school systems. We look for value-add properties. We work with sellers and brokers who have off-market properties and want a quick, discreet sale with confidence that buyers can close.

Properties

Do you own apartments or multi-family? Have a property for sale? Or a client who’s selling? We’re buying them!

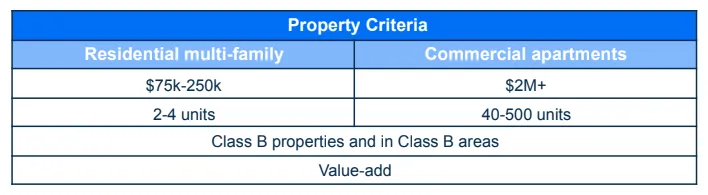

We look for value-add commercial apartment buildings as well as residential multi-family properties (2-4 units) in the sub-markets around:

Ohio: Cleveland, Akron/Canton, Columbus, Dayton, Cincinnati

Texas: Dallas, Houston, Killeen, San Antonio, Fort Worth

Oklahoma: Tulsa, Oklahoma City

For the areas’ larger commercial apartment buildings, we look in the range of $2M and up. Properties with 40 – 500 units fall into this category. For residential multi-family, our price range is $75k-250k. These properties should have 2-4 units to qualify.

Overall, we look for cash-flowing apartments and rentals. Our goal is to buy, stabilize, increase rents, refi, and pay off with lenders and investors quickly—typically within 18-30 months or less! We then hold the property to create long-term wealth for us and our investors.

Overall, we look for cash-flowing apartments and rentals. Our goal is to buy, stabilize, increase rents, refi, and pay off with lenders and investors quickly—typically within 18-30 months or less! We then hold the property to create long-term wealth for us and our investors.

Investment Strategy & Execution

Acquisition Strategy

Once acquired and funded, Blue-Ocean Capital Holdings and Freeland Ventures focuses on renovating and stabilizing investment properties. By drilling down on these often-distressed properties, we’re able to acquire high-value, high-demand properties in prime locations which, post-rehab, command significant rental income month after month, year after year.

Target Properties

“Distressed” “B” Class apartment buildings requiring cosmetic upgrades, modernized unit turns, updated amenities, software integration for tenants and high touch management

Under-performing properties with market and/or management-related challenges

Off-market opportunities and direct-to-seller opportunities that can be negotiated directly with owner(s)

Primarily focused specifically on Northeast Ohio Assets in the Cleveland, Akron, and Canton markets

Secondarily focused on strategic markets throughout Ohio such as Columbus, Dayton, and Cincinnati

Thirdly partnering with JV partners and Co-Sponsors throughout the Midwest and Southeast

To that end, our strategy typically centers on secondary & tertiary markets with sizeable populations, and steady economic growth. We anticipate these areas to increase in growth, opportunities and rental needs over time, making them ideal markets for pursuing multifamily investments. As interest rates and housing prices continue to climb, this will enable our investments to remain competitive with high-return potential.

Disclaimer:

The information provided on this website is for informational purposes only and does not constitute an offer or solicitation to sell securities. Investment opportunities discussed herein are open only to accredited and/or qualified investors as defined by applicable securities laws. Past performance is not indicative of future results. Investments in real estate involve risks, including but not limited to market fluctuations, tenant vacancies, and economic conditions. There can be no assurance that investment objectives will be achieved or that investors will receive any return on their investment. Prospective investors should consult with their financial, tax, and legal advisors before making any investment decisions.